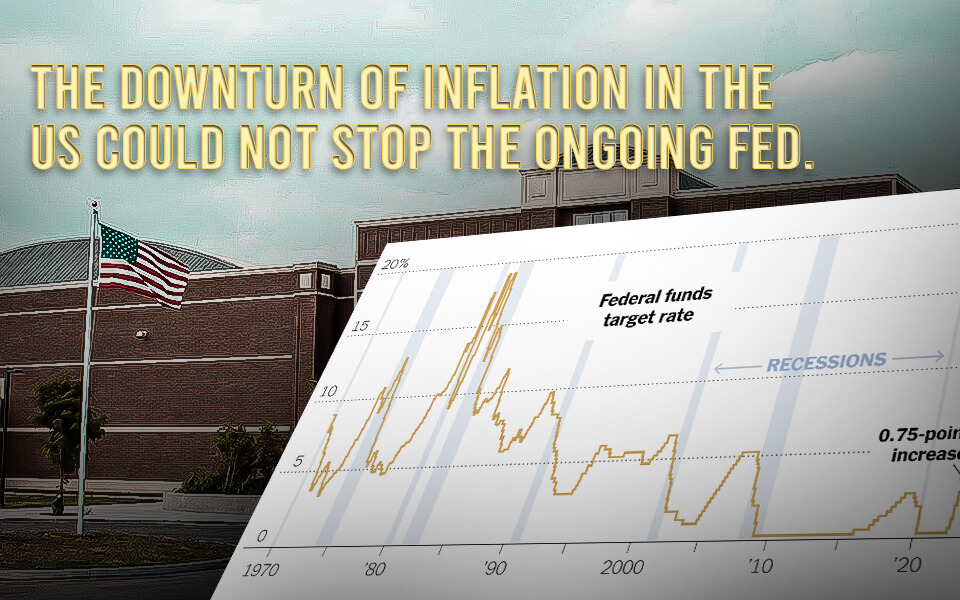

The downturn of inflation in the US could not stop the ongoing Fed

Consumer inflation has reduced in December as gasoline and oil prices have reduced, but not enough to counter the Fed rate hike. Economists expect the consumer price index to reduce by 0.1% every month but continue to increase to 6.5% from the previous year. However, the CPI marked a rate of 9.1% in June last year.

The consumer price index, excluding energy and food, is expected to have risen to 0.3% in December and seems to have a 5.7% YoY gain. The consumer price index report is expected on Thursday AT 8:30 a.m. ET.

The inflation in the US seems to be Pandora’s box for the economists as well as the governments as the inflation is taking its own course regardless of the Fed’s efforts in controlling the inflation. Traders and investors are still hesitant and expect another hike from the federal reserve. As a result, they look bearish in the market. A hike of 50 basis points will account for 20% of the market increase, where a basis point is equal to 0.01 of a percentage point.

Simona Mocuta, the chief economist at State Street Global Advisors, said, “It’s amazing how much reaction and overreaction there is for one single data point. She further said, “Clearly, the CPI is very important. In this case, it has fairly direct policy implications, which are about the size of the next Fed rate hike.”

Mocuta opined that a reduced CPI should influence the Fed. “The market has not priced the full 50. I think the market is right in this case,” she further added “The Fed can still contradict the market, but what the market is pricing is the right decision.”

According to economists, The continuous price hikes by the Federal Reserve Bank to counter inflation results in two possible outcomes, it will either reduce inflation or reduce economic growth. The strategies of the Federal Reserve Bank seem more of an effort to maintain the dollar price rather than comforting millions of Americans during inflation and recession.