Oil steady as market monitors Red Sea developments

On Wednesday, oil prices were barely altered as investors observed Red Sea developments, with several large shippers resuming passage through the area amid ongoing attacks and broader Middle East tensions.

Brent crude futures were down 5 cents, or 0.1%, to $81.02 a barrel by 0415 GMT, while West Texas Intermediate crude fell 12 cents, or 0.2%, to $75.45.

The benchmarks closed more than 2% higher in the previous session, as new attacks on ships in the Red Sea raised concerns about shipping disruptions, on top of expectations for interest rate reduction in the United States, which might stimulate economic growth and fuel demand.

Despite the strikes by Yemen’s Iran-backed Houthi militia, major shipping companies such as Maersk and France’s CMA CGM were resuming passage across the Red Sea after an international task force was deployed to the region.

“Even though shipping channels have been closed and vessels have been rerouted, the extent to which global supplies have been impacted is still debatable,” said Priyanka Sachdeva, senior market analyst at Phillip Nova.

On Wednesday, Hapag-Lloyd of Germany is likely to determine whether to resume Red Sea shipping.

The threat of an extended Israeli military campaign in Gaza is also a big market driver.

Israel’s Chief of Staff, Herzi Halevi, told reporters on Tuesday that the Gaza conflict would last “many months.”

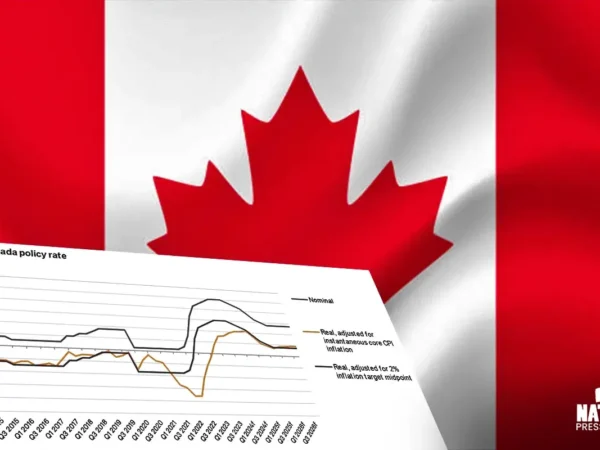

Oil price falls were also limited on Wednesday, as markets remained buoyed by expectations that the Federal Reserve of the United States will begin to decrease interest rates in 2024. Lower interest rates lower borrowing costs, which can encourage economic growth and increase oil demand.

According to a preliminary Reuters poll, oil stocks in the United States were predicted to dip by 2.6 million barrels last week, while distillate and gasoline inventories were expected to rise.

The American Petroleum Institute business association and the Energy Information Administration, the statistics arm of the United States Department of Energy, are set to release inventory figures on Wednesday and Thursday, respectively, a day later than usual due to the Christmas holiday.