Oil climbs on drop in Russia exports, Red Sea jitters

SINGAPORE, April 16 (Reuters) -Oil prices rose nearly 1% in early Asian trade on Monday, supported by lower Russian exports and as Houthi attacks on ships in the Red Sea raised concerns about oil supply disruption.

Brent crude futures were up 32 cents, or 0.4%, to $76.87 a barrel by 0413 GMT, while West Texas Intermediate crude was up 34 cents, or 0.5%, to $71.77 a barrel.

“The bad weather in Russia has played a part in the stronger open this morning as has the Houthis attack on ships close to Yemen,” Tony Sycamore, an analyst with the IG, said.

Russia said on Sunday that it would cut oil exports by 50,000 barrels per day or more in December, earlier than planned, as the world’s largest exporters try to support global oil prices.

This comes after Moscow suspended about two-thirds of its main export-grade Urals crude loadings from ports on Friday due to a storm and scheduled maintenance.

Shipping companies, including the world’s largest container shipping lines, MSC and A.P. Moller-Maersk, announced over the weekend that they would avoid the Suez Canal as Houthi militants in Yemen increased their attacks on commercial ships in the Red Sea.

Bab al-Mandab is a vital route for global seaborne commodity shipments, particularly crude oil and fuel from the Gulf bound westward for the Mediterranean via the Suez Canal or the nearby SUMED pipeline, as well as commodities bound eastward for Asia, including Russian oil.

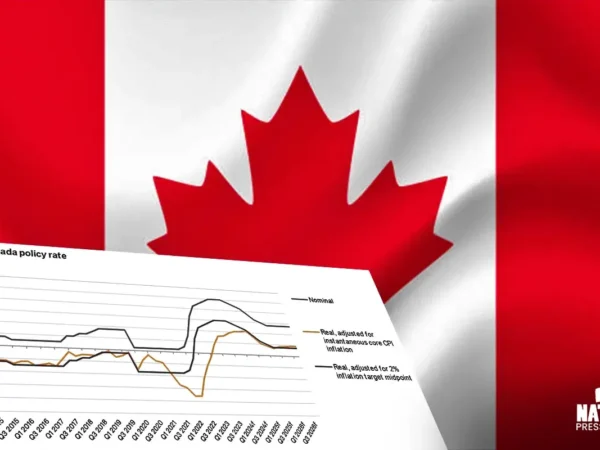

Brent and WTI both ended their longest streak of weekly declines in half a decade with a small gain last week, following a U.S. Federal Reserve meeting last week that raised hopes that interest rate hikes are coming to an end and cuts are on the way.

“I think just as importantly however is last week’s dovish Fed meeting which removes the tail risks of a hard landing for the U.S. economy and for crude oil demand going forward,” Sycamore said.

“Not to mention that the technical picture in crude oil supports a recovery into the $76/78 area,” he said, referring to WTI prices.

Crude oil was also supported by a weaker dollar and higher-than-expected U.S. inventory data, according to CMC Markets analyst Tina Teng in a note, because a weaker dollar makes dollar-denominated oil more affordable to foreign buyers.

Oil inventories at Cushing, Oklahoma, the top U.S. storage hub, rebounded last month after approaching operational lows due to improved pricing at the hub, which drew barrels from Texas’ Permian basin and higher Canadian crude flows, according to analysts.

The recent influx of crude from both locations has pushed Cushing inventories up for eight weeks in a row, to 30.8 million barrels.