Fed Officials Prepare to Extend Rate Pause Without Saying Hikes Are Done

The Federal Open Market Committee is unlikely to rule out more rate rises, given that data on the labor market and inflation show that the economy is still humming along.

Neel Kashkari, president of the Minneapolis Fed, who has a rotating vote on interest rates this year, said during a town hall meeting in North Dakota on Tuesday that it is too soon to declare victory.

Policymakers perceive a number of concerns, including shocks to food prices, a stronger housing market, and a slowing in the decrease of goods prices, that might drive inflation higher than they anticipate, according to minutes from the Fed’s September meeting released on Wednesday. Energy prices could continue to rise due to the predicted ground conflict between Israel and Hamas, which could increase inflationary pressures.

Despite the Fed raising rates by more than five percentage points since March 2022, recent economic statistics also showed that the economy is robust.

The number of jobs added by companies last month, 336,000, doubled experts’ predictions and represented the highest level since the year’s beginning. Producer prices increased more than anticipated, while core inflation, which excludes housing and energy services and is closely monitored by Chair Jerome Powell, also increased.

According to Priya Misra, a portfolio manager at JP Morgan Investment Management in New York, the frequent “head fakes” in the economic data will make officials reluctant to announce a stop to further tightening.

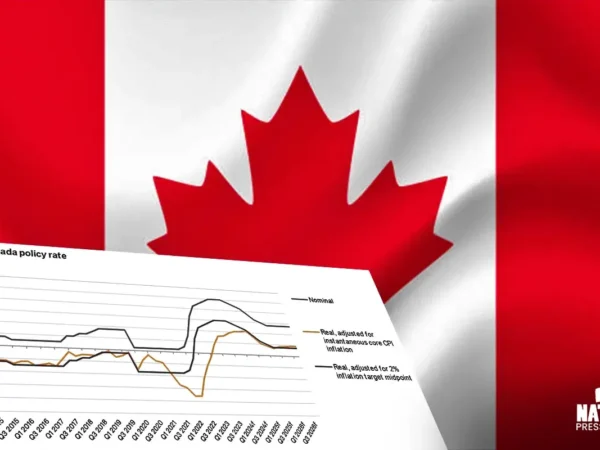

Fed policymakers are increasingly striving to strike a compromise between the need to bring inflation back to target and the risk of overshooting, which may lead to a probable recession. They also want to avoid making the same error as the Bank of Canada, which in June had to resume its rate-increase campaign after a temporary halt due to “excess demand” that lasted longer than expected.

The hardest part of policymaking, according to San Francisco Fed President Mary Daly, is trying to explain to the public how one must balance two types of risks.

However, a sharp increase in bond yields following the policy meeting on September 19–20 has prompted some officials to believe they can forgo a hike for a second time in a row because higher market rates are doing part of the work of restraint.

Philip Jefferson, Powell’s vice chair and a major spokesperson for Fed policy, stated on Monday that he is keeping an eye on the rise in Treasury yields as a potential further drag on the economy.

As he considered the direction of policy, he added, “Looking ahead, I will remain conscious of the tightening in financial conditions through higher bond yields.”

The 10-year US government bond yield reached its highest point since 2007 on October 6 before ending at 4.8%. When Fed officials hinted that a November boost might not happen, rates dropped back and ended the week at 4.61%.